See This Report about P3 Accounting Llc

Wiki Article

The smart Trick of P3 Accounting Llc That Nobody is Discussing

Table of ContentsThe Best Guide To P3 Accounting LlcThe Definitive Guide for P3 Accounting LlcP3 Accounting Llc for BeginnersThe Ultimate Guide To P3 Accounting LlcExcitement About P3 Accounting LlcNot known Details About P3 Accounting Llc

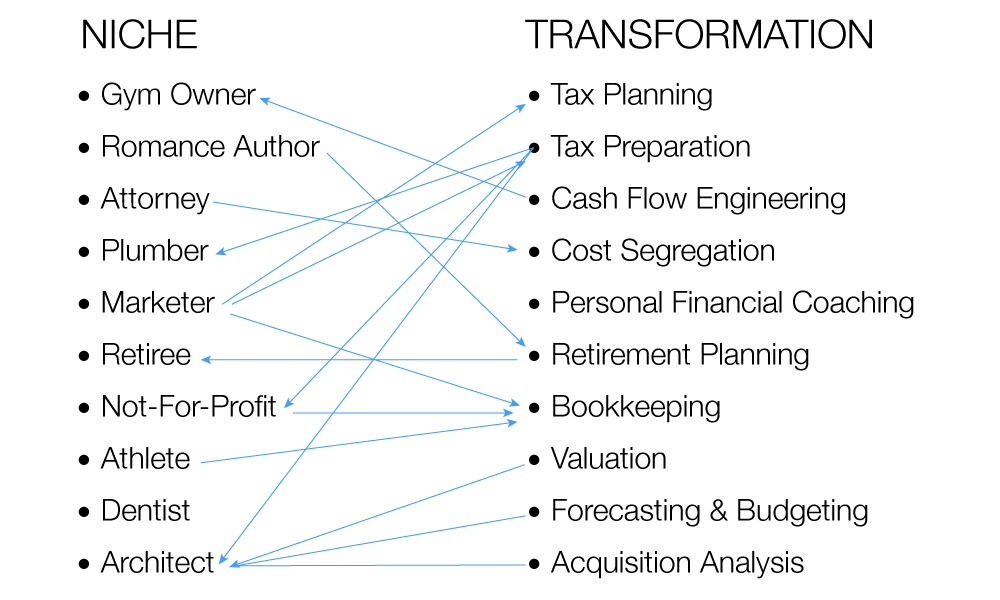

Or, as Merhib placed it, "You require to have the books in good order to recommend your clients on what they can be performing with their businesses." Many firms that use CAS offer either one or a tiny number of particular niches and permanently factor. "Customers desire professionals, not generalists," Mc, Curley claimed.

Yet acquiring this knowledge requires time, effort, and experience. To be an effective consultant, a CPA may require to become thoroughly knowledgeable about an offered market's processes, danger aspects, client types, KPIs, governing setting, and more. Certified public accountants who deal with physicians, for example, need to understand about invoicing and Medicare, while those that deal with dining establishments need to know concerning food patterns, delivery expenses, and state laws relating to tipping.

P3 Accounting Llc Things To Know Before You Buy

Having a particular niche can also aid firms concentrate their marketing initiatives and choose the ideal software. It can likewise aid a firm enhance its processes, something ACT Solutions understood when it selected to specialize. The company started out as generalists, remembered Tina Moe, CPA, CGMA, the owner and chief executive officer of ACT Services."I joked that our clients simply needed to be wonderful, be certified, and pay our expense." Now that they focus on 3 fields, Fuqua claimed, "we have the ability to systematize and automate and do points quicker." Since starting a CAS practice is such an intricate task, companies need to fully commit to it for it to grow (see the sidebar "Making Pizza Earnings").

That indicates devoting cash, team, and hours to the CAS venture. Ideally, have someone committed to CAS complete time, Merhib stated. CPA OKC. You might begin off having a staff participant from a various location working component time on your CAS effort, that's not lasting in the long run, he claimed.

The Best Strategy To Use For P3 Accounting Llc

Or else, he claimed, they'll have a hard time to be successful at stabilizing both aspects of the duty. Numerous resources now exist to aid firms that are beginning to use CAS. Organizations consisting of the AICPA have produced products companies can use to discover regarding CAS and supply training programs that cover whatever from pricing to staffing to just how to speak with clients regarding the worth of CAS.After her firm took some steps toward CAS by itself, she took a CAS workshop she discovered really useful. "We were attempting to take little bits and items of information from different resources to try and develop our very own CAS division, but it was like changing the wheel. It was really lengthy," she claimed.

Our P3 Accounting Llc Statements

As an example, Hermanek and his team were able to significantly boost a customer's cash circulation by getting them to adopt computerized receivables software application. By doing so, the client's balance dues dropped from approximately 50 days down to 30 days. Make sure to give your CAS team sufficient time to educate on technology, Hermanek claimed.

You possibly didn't start your organization to why not find out more process monetary declarations, spend hours investigating tax obligation conformity laws or fret concerning every detail of the deductions on your staff members' pay-roll. The "company" side of service can sometimes drain you of the energy you desire to route toward your core product and services.

Indicators on P3 Accounting Llc You Should Know

The services you can obtain from a professional accountancy company can be tailored to fulfill your demands and can consist of fundamental daily bookkeeping, tax services, bookkeeping, monitoring consulting, fraudulence examinations and can also act as an outsourced chief monetary officer to offer financial oversight for your small company. From the Big Four (Deloitte, Pricewaterhouse, Coopers, KPMG and Ernst & Young) to small-business accounting companies, the primary solutions used include audit and auditing.The company can assist you with long-range planning, such as getting building or updating your facilities. It can also aid you establish just how to break even and what your cash-flow demands are. These services help you intend your next moves, identify whether you are making an earnings and choose about your firm's development.

This could be a demand of your financiers or composed into the laws of your unification. https://www.awwwards.com/p3accounting/. Accounting firms conduct audits by analyzing not only economic records, but also the processes and controls in place to ensure documents are being correctly kept, plans are being stuck to, and your monetary methods help sustain your organization objectives and are one of the most efficient method to do so

P3 Accounting Llc Fundamentals Explained

A popular specialized area, numerous audit companies offer a series of tax obligation services. The company's accounting professionals can assist you identify a brand-new tax obligation code to aid guarantee your monetary reporting practices are in conformity with current IRS laws, identify your business's tax obligation liability, and make certain you fulfill filing demands and deadlines.

Report this wiki page